us exit tax percentage

Any gifts or bequests that you make as a covered expatriate to a US. You can make an irrevocable election to defer the deemed disposition tax on certain assets until it is actually sold providing you meet all the requirements from the instructions for Form 8854.

Renounce U S Here S How Irs Computes Exit Tax

The IRS Green Card Exit Tax 8 Years rules involving US.

. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. The exit tax does not apply to a US person who is not a covered expatriate or who can use one of the exceptions. To clarify this is not a separate or an additional tax.

It works like a step function. Last weeks Taxation 101 Where To Live Tax-Free essay was well received but raised lots of questions from American readers including many to do with what Id say is maybe the most misunderstood US. Status they are subject to the expatriation and exit tax rulesBut the rules are not limited to.

You will also be taxed on all your deferred compensation. The income between 9326 and 38700 will be taxed at 12. Citizens who have relinquished their citizenship and long-term residents who have ended their residency expatriated.

The Exit Tax Planning rules in the United States are complex. Exit Tax or apply for a bond which can be very expensive. If your 2018 income is 49000 and your status is single the first 9325 will be taxed at 10.

However depending on tax agreements this rate could be lowered to 15 per cent depending on how amounts are withdrawn. Green Card Exit Tax 8 Years Tax Implications at Surrender. Citizenship or long-term residency by non-citizens may trigger US.

Source income as it is received. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. These rules and exceptions present some exit planning opportunities.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. 6 NovemberDecember 2020 Pg 60 Gary Forster and J. Currently net capital gains can be taxed as high as 238 including the net.

The general proposition is that when a US. About Form 8854 Initial and Annual Expatriation Statement. Expatriation from the United States.

The expatriation tax consists of two components. Base Fare - our ticket price plus US. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

US Exit Tax IRS Requirements. Total Fare - base fare plus airport charges government taxes and fees and carrier imposed. If you are covered then you will trigger the green card exit tax when you renounce your status.

The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as. Excise and departurearrival taxes when they apply. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

Depending on what the total gain is if the gain exceeds the exemption amount currently 725000 the expatriate may have to pay a US. Tax on individualsthe Exit Tax Americans have to pay when they give up their US. In general 30 percent in taxes will be withheld automatically when distributions are paid out.

The most important aspect of determining a potential exit tax if the person is a covered expatriate. The deemed gains are reported on the final US tax return with tax rates varying by asset type for example if artwork is deemed sold it is subject to the special 28 percent rate. Form 8854 is used by individuals who have expatriated on or after June 4 2004.

Citizen will be subject to provisions of the exit tax. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them.

In some cases you can be taxed up to 30 of your total net worth. Expatriation tax provisions apply to US. Here are the charges you will see on your ticket and their explanations.

The total amount of the gift is reduced by the annual gift exclusion 13000 in 2011 and then subject to the highest marginal. The goal Poitras points out is to avoid being taxed twice For example in Canada the tax rate on an RRSP withdrawal is generally 25 per cent for non-residents. The exit tax and the inheritance tax.

If the IRS can rely on tax withholding rules to assure full collection of income tax the covered expatriate pays tax at a 30 rate on US. Legal Permanent Residents is complex. Exit tax applies to United States expatriates a term describing people who have renounced their US citizenship and those who have renounced a Green Card that they have held for at least eight years out of the.

Exit Tax Expatriation Planning. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Green Card Exit Tax 8 Years.

Citizen renounces citizenship and relinquishes their US. Taxes and carrier-imposed Fees - airport charges government taxes and fees and carrier-imposed surcharges. As a result of this election no subsequent distribution from the trust to the covered expatriate will be subject to 30 percent withholding Notice 2009-85 7D.

Planning around the exit tax. The rest of your income the amount over 38700 up to 49000 will be taxed at 22.

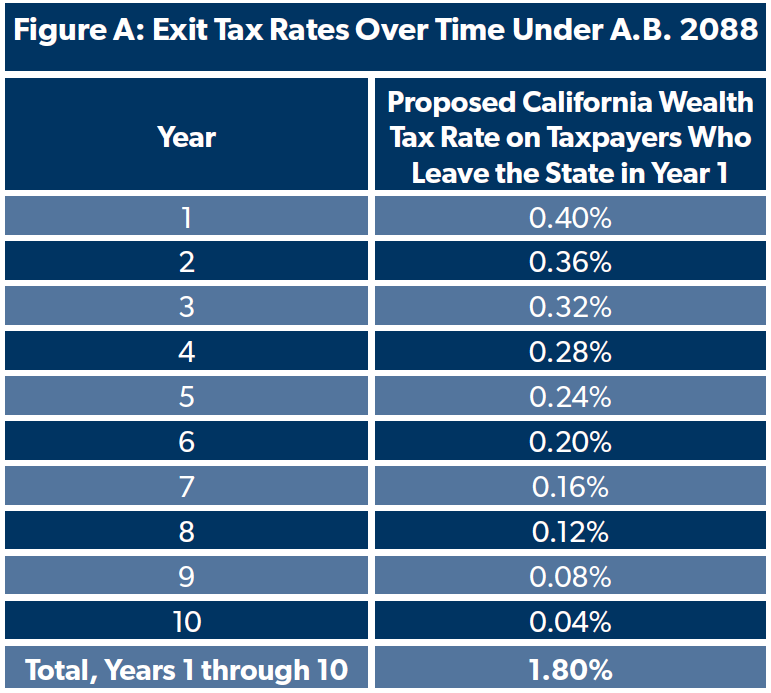

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

The Paris Climate Change Summit Explained In 4 Charts Paris Climate Change Climate Change Paris Climate

Studio Light Wordpress Theme 58187 Templatemonster Wordpress Template Web Design Web Inspiration

Infographic How Does Startup Valuation Work The Tech Bulletin Start Up Startup Infographic Infographic

Exit Tax In The Us Everything You Need To Know If You Re Moving

A Taxing Blog Prompt Prompts Writing Prompts Writing Poetry

Samvat 2075 Was A Year Of Diis Sip Flows Helped Cushion Fii Outflow Hit Dividend Investing Investing Books Systematic Investment Plan

Corporate Credit Rating Scales By Moody S S P And Fitch Wolf Street Credit Rating Scale Credit Rating Rating Scale